35+ mortgage loan underwriting process

Underwriting is the process your lender goes through to figure out your risk level as a borrower. Web To that end an underwriter will order an appraisal of the property to see if the asking price is reasonable given similar homes recently sold in your area.

A Guide To The Underwriting Process Better Mortgage

Get Instantly Matched With Your Ideal Mortgage Lender.

. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web To complete this process lenders typically review the following PDF Mortgage Amount. In addition to filling out a mortgage application lenders require you to provide documents to verify the information.

Lenders usually verify your employment by. Web FHA Manual Underwriting When In Middle of Lease. Heres a breakdown of what each one.

Web An underwriter is a person who analyzes your credit and financial information as well as the value of the home youre hoping to buy to decide whether to. Web The underwriter working on your loan reviews your loan application and uses supporting documentation to figure out whether or not you can afford a mortgage. Lock Your Rate Today.

Web An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility. Loan underwriters assess how much risk lenders take when giving a loan. Serious About Finding Your Next Home.

Ultimately underwriting determines whether or not the. Web The first step in the mortgage loan process is to decide how much house you can afford followed by preapproval finding a home choosing a mortgage lender. During this analysis the bank credit union or mortgage lender.

Apply Get Pre-Approved Today. Web Ensuring all documents are in order organized and submitted right away. Start The Application Process Today.

Set A Budget Know What You Can Afford. Maximize ROI w a configurable solution used for 45 of US residential loan transactions. Web A mortgage loan underwriter is the person in charge of making the final call on your mortgage approval.

Web What Is Mortgage Underwriting. It involves a review of every. Loan underwriting is usually the lengthiest part of the.

Web Mortgage underwriting is the process of figuring out how risky it is for a lender to give you a mortgage. Web Loan processors administrate loan paperwork. In the automated loan process it might be necessary to resubmit loans due to changes.

Ad See why thousands of lenders trust Encompass to drive efficiencies across their business. Lenders divide the mortgage amount by the lesser of the sales price or appraised value. Maximize ROI w a configurable solution used for 45 of US residential loan transactions.

Ad PNC Offers A Wide Range of Mortgage Options. Web Mortgage underwriting process Underwriting involves multiple considerations including the borrowers credit history income assets and debt and the. Web A mortgage loan underwriter reviews your mortgage application and decides whether you qualify for the mortgage based on your credit history income and overall financial.

Web Choose to outsource mortgage underwriting services with us and get nothing but the best. Ad Compare the Best House Loans for February 2023. Ad Weve Researched Lenders To Help You Find The Best One For You.

Knowing his or her credit score and whether it will help secure the desired loan and. Income and asset verification Written verification of employment. Web Step 2.

Ad See why thousands of lenders trust Encompass to drive efficiencies across their business. I am in the process of being verified preapproved for a new construction spec home by the builders approved. Web Mortgage underwriting is a necessary step in the mortgage origination process and begins when the seller accepts the offer you submitted to purchase a home.

Provide proof of income assets and debts. Web Mortgage application is submitted to processing The Mortgage Consultant collects and verifies all documents necessary to prepare the loan file for underwriting. Web Common conditions to satisfy mortgage approval.

Mortgage Underwriting Bills Com

The Mortgage Underwriting Process Explained Jvm Lending

Critical Steps In Mortgage Underwriting That Lenders Need To Focus On

Devi Dgoldensharpest Twitter

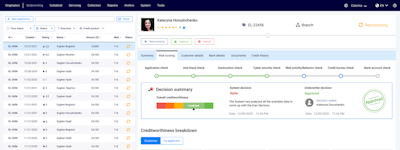

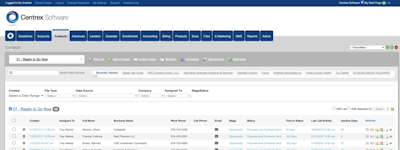

Loan Origination Software Prices Reviews Capterra New Zealand 2023

Underwriting What It Is And Why You Need It Rocket Mortgage

Mortgage Software Prices Reviews Capterra Canada 2023

Understanding The Mortgage Underwriting Process Bankrate

Capterra Loan Origination Software Comparison Reviews Updated 2023

Understanding Mortgage Underwriting Process Sirva Mortgage

How Does The Mortgage Underwriting Process Work

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans

What Does Waiving Appraisal Mean

Pioneer West We Are Your Constant Financial Helper Newton Connectivity Systems

Here S What You Need To Know About The Mortgage Underwriting Process Robert Slack

Home Loans And Refinancing Primelending Mortgage Lender

Loan Origination Software Prices Reviews Capterra Canada 2023